PropFTX on Shark Tank India: A Big Idea That Failed to Win the Sharks

Three points you will get to know in this article:

1. PropFTX sought ₹1 crore for 1.5% equity valuation

2. All five sharks rejected due to timing and trust

3. FTX name association raised major red flags immediately

PropFTX on Shark Tank India Season 5: The Pizza Analogy That Couldn't Convince the Sharks

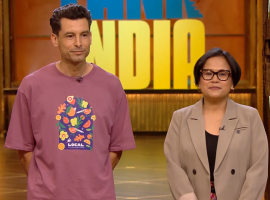

Rajeev Chhabra and Varun Singhi walked into the Shark Tank India studio with a bold vision, turning premium real estate into affordable slices that anyone could own. Their platform, PropFTX, promised fractional ownership of high-value properties through blockchain technology and AI-powered tools. But despite the innovative pitch, they walked out empty-handed after facing some of the harshest critiques of Season 5.

The founders began their presentation with a pizza metaphor. “We’re not here to sell pizza,” Rajeev announced. “We’re here to explain how you can invest in India’s most loved asset class, real estate, with minimal capital, just like enjoying different slices of pizza instead of buying the whole pie.”

It was creative. It was simple. But it wasn’t enough.

What is PropFTX?

PropFTX operates as a digital marketplace where investors can buy fractional shares of premium properties. Instead of needing ₹100 crore to own a luxury apartment, you could theoretically invest ₹50 lakh and own a legal share through a Special Purpose Vehicle (SPV) structure.

Here’s how PropFTX works:

- Each property is divided into a maximum of 200 fractions (limited by Private Limited Company regulations)

- Investors purchase tokens representing their ownership stake

- They become legal co-owners with rights to rental income and capital appreciation

- An AI-powered valuation tool provides real-time market pricing with claimed accuracy of 92% in Bangalore and 99% in Dubai

The platform uses escrow accounts to hold investor funds until deals are fully verified, adding a layer of security.

Official Website – PropFTX

The Founders Behind PropFTX

Rajeev Chhabra brings 40 years of real estate expertise to the table. Varun Singhi complements him with 20 years of tech and Web3 experience. They met on LinkedIn three years ago, and despite their 20-year age gap (Rajeev is 62, Varun is 42), they connected over coffee within 30 minutes.

“We gelled,” Rajeev explained during the pitch. Their partnership revolves around combining traditional real estate wisdom with cutting-edge technology.

PropFTX Equity Split:

- Rajeev Chabra: 82.5%

- Varun Singhi 5%

- Other Stakeholders: 12.5%

The Numbers That Didn't Add Up for PropFTX

When the sharks dug into the financials, cracks started to appear.

Current Status of PropFTX:

- Pre-revenue stage (₹15 lakh revenue last year)

- ₹7 crore invested by Rajeev over three years

- Five builders onboarded

- Five properties listed (total value: ₹66 crore)

- 120 performance marketing inquiries (mostly for commercial properties, very low for residential)

PropFTX Revenue Model:

- 1% onboarding fee from builders

- 3% success fee from builders (upon sale)

- 5% platform fee from buyers

- 3% interest on funds held in escrow

PropFTX Pitch on Shark Tank India

Rajeev Chhabra and Varun Singhi stepped into Shark Tank India Season 5 requesting ₹1 crore in exchange for 1.5% equity, placing their company valuation at ₹66 crore. Their mission? Making premium real estate accessible through fractional ownership.

Anupam Mittal immediately spotted the problem: “Your real customer is the builder, not the investor. You earn 4% from builders and only 2.5% from users. So your incentive is to sell the builder’s inventory, not serve the customer.”

Kunal Bahl took it further: “You’re using the word ‘overhang inventory.’ That means the builder assumed there would be demand, but there wasn’t. Now you’re doing performance marketing to create artificial demand for a product the market already rejected.”

Liquidity Concerns and the Exit Problem

Vineeta Singh raised another fundamental issue: liquidity.

“How do I sell my fraction when I need the money?” she asked.

Varun explained that sellers can list their tokens on the platform, but there must be buyer demand. “Real estate doesn’t sell overnight. It takes time,” he admitted.

The sharks weren’t convinced. The lack of a clear secondary market mechanism meant investors could be stuck holding illiquid assets with no easy exit route.

The Sharks Start Dropping Out, One by One

Anupam Mittal Exits First: Anupam was the first to make his decision clear. He explained that in India, less than 5% of people invest in direct equity. Less than 1% do alternative investments.

“If we talk about real estate fractionalizing, I think it will take time to create demand, to create the market, and to bring it. I am out,” Anupam stated.

His reasoning was simple: market penetration for even basic equity investments is extremely low in India. Alternative investments are practically non-existent. Building demand for fractional real estate would take years, maybe decades.

Vineeta Singh Questions the Strategy: Vineeta came next with concerns about execution and focus.

“Rajeev ji, Varun ji, when you’re creating a category where no existing model exists, your first doubt should be whether enough sellers and enough buyers will come,” she began. “You could have tested all this in one location rather than being in five cities by spending under a crore to figure out demand-supply match early.”

She pointed out significant challenges in the revenue model and business approach. Despite her personal childhood dream of co-owning property with friends in Goa, she couldn’t justify the investment.

“Bringing it to a tech platform and making co-ownership bigger in India, all the best to you,” she concluded warmly before stepping out.

Namita Thapar Sees Multiple Flaws: She felt the business model had several fundamental flaws.

“I think your business model has many such flaws. There’s a trust flaw. There’s no clarity on liquidity. Indian investors are just now starting to put in REITs little by little. People are not ready for this kind of a product today. I am out. Thank you,” Namita stated bluntly.

She listed the problems systematically:

- Trust issues between complete strangers co-owning property

- Unclear liquidity mechanisms

- Complexity that scares away average investors

Her final verdict was swift and definitive.

Varun Alagh Offers a Nuanced Perspective: Varun Alagh disagreed with some of the earlier assessments, particularly Namita’s view on demand.

“I’m going to slightly disagree that this product won’t have demand or need. I think the desire exists among many people in India to invest fractionally in good property, in good assets,” he began.

But he quickly identified the real problem: “For this to come, regulation will need to evolve significantly. You’re currently playing around regulations. Whether the timing is right for this business, that is a very big question for me. For this reason, I am out.”

He acknowledged the desire exists among Indians to invest in quality real estate fractionally. But he pointed out that the regulatory framework simply doesn’t exist yet. The founders were “playing around regulations” rather than operating within a clear legal structure.

Kunal Bahl Delivers the Final Blow: Kunal was the last shark to speak, and his critique was perhaps the most damning.

“I feel the biggest problem in this business right now is that there’s no customer-first approach,” Kunal began.

He returned to the FTX naming issue and connected it to a broader problem of customer orientation.

“FTX was one of the biggest scams in the US. Their founder is sitting in jail. Why haven’t you changed your name? When someone Googles PropFTX, articles about FTX fraud will come up. Do you want any association with that?”

After the founders responded, Kunal drove his point home: “Somewhere your customer orientation is missing in this business. Whether you’re selling fractional real estate, shampoo, makeup, or anything in this world, if there’s no customer-first approach, success will be very difficult. For this reason, I am out today. Wish you all the best.”

His message was clear: without putting customers first, success would remain elusive.

What Happens Next for PropFTX?

Despite walking away without a deal, Rajeev Chhabra remains defiant and optimistic.

“Within six months, this will come to India, and I know it. We’ve worked so hard, and we will succeed. When your heart is pure, God supports you,” he declared after the pitch.

The founders plan to continue their mission of onboarding one million square feet of diverse real estate projects. Rajeev stated he’s willing to keep investing his personal funds “till eternity.”

Lessons from the PropFTX Pitch

This pitch highlighted several critical challenges facing fintech and proptech startups in India:

- Trust remains the biggest barrier: Without established credibility or regulatory backing, convincing people to invest in fractional assets is extremely difficult.

- Branding matters immensely: The FTX association, intentional or not, created immediate negative perception that could have been avoided with a simple name change.

- Customer-first approach is non-negotiable: When your revenue model incentivises you to serve builders over investors, your entire value proposition becomes questionable.

- Timing is everything: Even great ideas fail if launched before the market or regulatory environment is ready.

- Focus beats expansion: Testing in one location thoroughly would have been smarter than spreading across five cities with limited resources.

PropFTX’s journey on Shark Tank India serves as a reminder that innovation alone doesn’t guarantee investment. Execution, timing, trust, and market readiness matter just as much, if not more.

- Eight Times Eight on Shark Tank India Season 5 Episode 28: A Strategic Chess Move in EdTech - February 12, 2026

- PropFTX on Shark Tank India: A Big Idea That Failed to Win the Sharks - February 12, 2026

- The Binge Town Wins Big on Shark Tank India Season 5 Episode 28 - February 12, 2026